White

Paper

Treint

Investment Inc. 2024

This

time. To avoid any doubts, Treint Investment Inc. is solely a corporate

denomination and does not represent an instrument equivalent to a “security”,

as defined in applicable US regulation. Whitepaper is being provided by Treint

Investment Inc. for informational purposes only and is not a binding legal

agreement. The purchase and supply of Treint Investment Inc. shall be governed

by terms and conditions, which is a separate document that will be provided to

purchasers who qualify to participate in the share purchase event. This

Whitepaper may be amended from time to time.

ABSTRACT................................................................................................................................................................................................................. 2

HIGHLIGHTS OF THE OFFERING......................................................................................................................................................... 3

1. DISCLAIMERS..................................................................................................................................................................................................... 4

a) The Share Offering......................................................................................................................................................................................... 4

b) Eligibility.......................................................................................................................................................................................................... 4

c) Legal disclosures............................................................................................................................................................................................. 4

d) Forward- looking statements........................................................................................................................................................................ 5

e) Accuracy of information, no consent of

parties referenced in Whitepaper........................................................................................ 6

f) Terms used........................................................................................................................................................................................................ 6

g) No further information or update............................................................................................................................................................... 7

h) Know Your Customer and Anti-Money

Laundering policies.............................................................................................................. 7

2. MEDTECH MARKET........................................................................................................................................................................................ 8

a) Introduction...................................................................................................................................................................................................... 8

b) Current Environment in Med Tech.............................................................................................................................................................. 9

c) Treint Investment Inc. & Med Tech............................................................................................................................................................. 9

d) Description of projects:............................................................................................................................................................................... 10

e) Perspective of Treint’s Solutions in the

MedTech Industry:................................................................................................................. 12

f) Development plan 2023-2025..................................................................................................................................................................... 13

g) Momentum: a great opportunity to MED TECH.................................................................................................................................... 13

h) Legal Structure.............................................................................................................................................................................................. 15

3. OUR SHARES..................................................................................................................................................................................................... 17

a) Shares.............................................................................................................................................................................................................. 17

b) Share Offering (SO) Structure.................................................................................................................................................................... 17

c) Purchase structure, in practical terms,

how does the SO and License Agreements work:............................................................... 17

e) Benefits for Shareholders............................................................................................................................................................................ 21

4. RoadMap............................................................................................................................................................................................................... 23

5. Target assets - Key aspects and indicators................................................................................................................................................... 24

6. TEAM AND PACTUAL EXPERIENCE..................................................................................................................................................... 26

a) Company........................................................................................................................................................................................................ 26

b) Team............................................................................................................................................................................................................... 26

7. Focus on value creation - the Treint

differentials...................................................................................................................................... 29

8. Technology for Management........................................................................................................................................................................... 30

a) Intelligence..................................................................................................................................................................................................... 30

b) CRM: Intelligent pricing, management and

sales.................................................................................................................................. 30

c) Sensing for monitoring and analysis......................................................................................................................................................... 30

d) Business Intelligence.................................................................................................................................................................................... 30

e) Geospatial Vision of 100% of Portfolio................................................................................................................................................... 30

9. Risk factors........................................................................................................................................................................................................... 31

10. Marketing notes................................................................................................................................................................................................ 39

11. Notes & Alerts................................................................................................................................................................................................... 40

ABSTRACT

HIGHLIGHTS

OF THE OFFERING

The

share offering aims to provide each Purchaser with the opportunity to

indirectly invest in Med Tech service distressed assets;

The

project leveraged on IT technology based on Artificial intelligence backed by a

profitable and well-capitalized investments, with the expertise / strength of

Crowe investment value report and Treint Holding Inc. their positive track

record;

● Transparent

investment decisions and full disclosure of financial records;

● Compliant

KYC/AML purchase of Shares;

● Shareholders

will potentially benefit from payments - in the form of Crypto currency or a

USD (“Fiat”) - based on the performance of a portfolio of Med Tech Services

such as Treint Business platform (“Target Assets”).

1.

DISCLAIMERS

a)

The

Share Offering

This Share Offering (“SO”) aims at raising funds for a

diversified portfolio of Med Tech assets located in the United States of

America (here and after US).

The SO aims to tap into both the global base of

liquidity allocated to Initial Coin Offerings (“ICO”) as well as regular

investors in financial and capital markets. This SO intends to be fully

compliant with any and all KYC/AML and tax obligations and securities

regulations. Trading of the Shares (as defined below) in the secondary market

is expected to take place in the near future.

For prospective purchasers, the SO (i) brings a unique

opportunity to access, through a low-cost/tax-efficient structure, the Med Tech

services market, (one of the fastest-growing markets), (ii) relies on the

expertise, proven track record and credibility of the Treint team and (iii) is

conducted through a simple, direct and innovative way using a AI-based

technology asset.

b)

Eligibility

Treint Investment Inc. (“Issuer”) is an exempt

foundation company incorporated under the United States of America Law, subject

to the provisions and obligations related to Anti-Money Laundering (“AML”) and

Know Your Customer (“KYC”), namely the Proceeds of Crime Law (Revised) and the

Anti-Money Laundering Regulations (Revised). This SO is intended for

international purchasers based worldwide, excluding persons with

residence/nationality from the United States of America, as well as any other

country where the purchase of shares is legally forbidden, in addition to

persons located in any of the jurisdictions blacklisted by the Organization for

Economic Co-operation and Development and the United Nations.

c)

Legal

disclosures

This Whitepaper provides information in connection to

an opportunity for the acquisition of shares that will grant purchasers

economic exposure to Med Tech services such as Treint Business Platform (Target

Assets) by means of periodic profit distributions. The Shares will not (i)

provide legal ownership over the Issuer’s shares or the Target Assets; (ii)

represent debt owed by the issuer to the Shareholders; nor (iii) provide

voting/governance/typical shareholding rights related to the Issuer.

This Whitepaper does not constitute a prospectus, an

offering memorandum and/or other offering document relating to the Issuer and

has not been reviewed or approved by any financial regulator or securities

commission in any jurisdiction. Investing in Shares involves several risks.

There can be no assurance that Shareholders will be able to receive a payback

of their capital or any positive returns on their purchase of shares. Prior to

investing in Shares, prospective purchasers should carefully consider the

section “Risk Factors” of this Whitepaper, which despite not providing an

exhaustive list or explanation of all the risks purchasers may face when

investing in Shares, shall be used as guidance. Prospective purchasers should

consider carefully whether a purchase of Shares is suitable for them

considering the information herein and their personal legal and financial

circumstances. Unless otherwise indicated or the context otherwise requires,

all references in this Whitepaper to “Issuer”, “we”, “our”, “ours”, “us” or

similar terms refer to the Issuer.

d)

Forward-

looking statements

This Whitepaper may contain estimates and

forward-looking statements which are mainly based on the current expectations

and estimates of future events and trends that affect or may affect the

business, financial condition, results of operations, cash flows, liquidity,

prospects and the envisaged valuation of the shares. Although we believe that

these estimates and forward-looking statements are based upon reasonable

assumptions, they are subject to many significant risks, uncertainties and are

made in light of the current available information. Forward-looking statements

speak only as of the date they were made, and we do not undertake the

obligation to update publicly or to revise any forward-looking statements after

we distribute this document because of new information, future events or other

factors. Considering the risks and uncertainties described above, the

forward-looking events and circumstances discussed in this document might not

occur and future results may be materially different from those expressed in or

suggested by these forward-looking statements.

Forward-looking

statements involve known and unknown risks, uncertainties and other factors

which may cause actual events or results, performance or achievements to differ

materially from the estimates or the results implied or expressed in such

forward-looking statements. These factors include, amongst others:

A

- changes in political, social, economic and stock market conditions, and the

regulatory environment in the countries in which the Issuer conducts its

businesses and operations;

B

- the risk that the Issuer may be unable to execute or implement its respective

business strategy and future plans;

C

- changes in interest rates and exchange rates of fiat and crypto currencies;

D

- changes in the anticipated growth strategies and expected internal growth of

the Issuer;

E

- changes in the availability and salaries of employees who are required by the

Issuer to operate their respective businesses and operations.

F

- changes in competitive conditions under which the Issuer operates, and the

ability of the Issuer to compete under such conditions;

G

- changes in the future capital needs of the Issuer and the availability of

financing and capital to fund such needs;

H - war or acts of international or domestic

terrorism;

I

- occurrences of catastrophic events, natural disasters and acts of God that

affect the businesses and/or operations of the Issuer; and

J - other factors beyond the control of the Issuer.

The

Issuer disclaims any responsibility to update any of those forward-looking

statements or publicly announce any revisions to those forward-looking

statements to reflect future developments, events or circumstances, even if

new information becomes available or other events occur in the future.

e)

Accuracy

of information, no consent of parties referenced in Whitepaper

This

Whitepaper includes technical, market and industry information and forecasts

that have been obtained from internal surveys, reports and studies, where

appropriate, as well as market and academic research, publicly available

information and industry publications. Such surveys, reports, studies, market

research, publicly available information and publications generally state that

the information that they contain has been obtained from sources believed to

be reliable, but there can be no assurance as to the accuracy or completeness

of such included information.

Save

for the Issuer and its respective directors, executive officers and employees,

no person has provided his or her consent to the inclusion of his or her name

and/or other information attributed or perceived to be attributed to such

person in connection therewith in the Whitepaper and no representation,

warranty or undertaking is or purported to be provided as to the accuracy or

completeness of such information by such person, and such persons shall not be

obliged to provide any updates on said information.

The

Issuer has not conducted any independent review of the information extracted

from third-party sources, verified the accuracy or completeness of such

information or ascertained the underlying assumptions relied upon therein.

Consequently, the Issuer makes no representation or warranty as to the accuracy

or completeness of such information and shall not be obliged to provide any

updates on said information.

Except

as otherwise mentioned below, all the data and information from the charts are

available in open sources.

f)

Terms

used

To

facilitate a better understanding of the “Shares” being offered for purchase by

the Issuer, and the businesses and operations of the Issuer, certain technical

terms and abbreviations, as well as, in certain instances, their descriptions,

have been used in the Whitepaper. These descriptions and assigned meanings

should not be treated as being definitive of their meanings and may not

correspond to standard industry meanings or usage. Words importing the

singular shall, where applicable, include the plural and vice versa and words

importing the masculine gender shall, where applicable, include the feminine

and neuter genders and vice versa. References to persons shall include

corporations.

g)

No

further information or update

No person has been or is authorized to give any

information or representation not contained in the Whitepaper in connection

with the Issuer and its business and operations or the Shares and, if given,

such information or representation must not be relied upon as having been

authorized by or on behalf of the Issuer. The continuing sale of Shares shall

not, under any circumstances, constitute a continuing representation or create

any suggestion or implication that there has been no change, or development

reasonably likely to involve a material change in the affairs, conditions and

prospects of Issuer or in any statement of fact or information contained in the

Whitepaper since the date hereof.

Statements made in the White Paper are based on the

law and practice in the United States of America currently at the date it was

issued. Those statements are therefore subject to change should that law or

practice change. Under no circumstance does the delivery of the Whitepaper or

the sale of Shares imply or represent that the affairs of the Issuer have not

changed since the date of the White Paper.

h)

Know

Your Customer and Anti-Money Laundering policies

Any applicants to the SO, either in a primary issuance

or in the secondary market, will be subject to all applicable KYC/AML policies

that may be in place at the time of the purchase, being subject to periodic

assessment and routines in this regard. Failure to comply with the KYC/AML

procedures and routines applicable to the purchase of Shares shall prevent the

purchase of the Shares or the imposition of sanctions on purchasers, including

the freeze of funds, mandatory cancellation or redemption of Shares through

our Share Purchase Agreement or any other measure that the Issuer may deem

appropriate to meet the applicable regulatory requirements.

2.

MEDTECH

MARKET

a)

Introduction

In an era characterized by exponential advancements in

technology, the healthcare industry is experiencing a profound transformation,

driven by the convergence of medicine and technology. Med Tech platforms and

applications have emerged as pivotal catalysts, orchestrating this paradigm

shift. They are revolutionizing the way healthcare is delivered, accessed, and

experienced by patients, providers, and stakeholders alike. This white paper

explores the dynamic landscape of Med Tech platforms and applications, shedding

light on their profound impact on healthcare systems worldwide.

As the demand for accessible, cost-effective, and efficient

healthcare services continues to grow, Med Tech platforms and applications have

risen to meet these challenges head-on. These platforms encompass a broad

spectrum of technologies, ranging from wearable health monitoring devices and

telemedicine solutions to electronic health records (EHR) systems and advanced

artificial intelligence (AI) algorithms. Through seamless integration and

utilization, they are fostering a holistic healthcare ecosystem that promotes

early disease detection, personalized treatment plans, and enhanced patient

engagement.

Furthermore, the ongoing global health crisis has

underscored the critical role of Med Tech platforms and applications. The

COVID-19 pandemic accelerated the adoption of telemedicine, remote patient

monitoring, and digital health tools, proving their ability to bridge

geographical gaps and minimize healthcare disparities. Beyond crisis

management, these technologies are poised to create lasting improvements in

healthcare delivery, enabling a future where preventive care takes precedence

and chronic conditions are managed proactively.

In this white paper, we will delve into the

multifaceted dimensions of Med Tech platforms and applications. We will explore

their impact on various stakeholders, from healthcare providers seeking

operational efficiencies to patients demanding greater control over their

health. We will analyze the regulatory and ethical considerations that

accompany this transformative wave and examine the challenges and opportunities

that lie ahead.

Join us on a journey through the digital corridors of

modern healthcare as we uncover the transformative power of Med Tech platforms

and applications. Together, we will explore the promise they hold for a

healthier, more accessible, and equitable future in healthcare delivery.

The global market of AI systems for medical

diagnostics is estimated at $1.22 billion In mid-November 2022, Research And

Markets published the results of a study of the global market for artificial

intelligence (AI)-based systems for medical diagnostics. Analysts predict that

this industry will demonstrate steady growth. The report says that the costs in

this area will reach $1.22 billion by the end of 2022. In the future, the CAGR

(average annual growth rate in compound percentages) is expected to reach

24.16%. Thus, by 2027, the market volume may increase approximately three times

— up to $3.60 billion. The drivers of the industry are the introduction of AI

tools in radiology and pathology; the growing demand for intelligent systems against

the background of management optimization and reduction of human errors;

improved and more accurate diagnosis of complex diseases. Cloud technologies

and advances in intelligent image recognition will also contribute to the

development of the market. At the same time, there are several constraining

factors: higher cost compared to traditional means; the complexity of creating

models and mechanisms for AI; issues related to cybersecurity and privacy.

b)

Current

Environment in Med Tech

The development of Artificial Intelligence is a

priority task for many countries of the world today. If we consider the

introduction of smart systems in the medical field, then first of all their

benefit will consist in increasing the accuracy of diagnosis of various diseases.

The practice and experience of a doctor may not be enough to identify a

particular problem in the human body in a timely manner, whereas a neural

network with access to a huge amount of data, advanced scientific literature

and millions of medical histories will be able to quickly classify any case,

correlate it with similar problems in other patients and propose a treatment

plan. In the analysis of various medical data, artificial intelligence already

shows excellent results – the accuracy of detecting pathologies by ultrasound

and MRI exceeds 90%. At the same time, the work of the hospital requires rapid

coordination of staff and available resources, because not only health, but

also people's lives are at stake. AI in healthcare can significantly help in

clinic management.

Novel health conditions, as well as increasing

expectations from healthcare, have contributed to a technological revolution

inside the industry, and medical AI is its cornerstone.

AI in healthcare is the emulation of human cognition

and reasoning by complex algorithms in order to automate, scale and enhance

processing, analysis, interpretation and comprehension of healthcare data and

augment human activity.

By relying heavily on machine learning and deep

learning, AI quickly and accurately handles big amounts of data, provides

contextual relevance, reduces human error and makes reliable decisions.

AI disrupts the healthcare industry and revolutionizes

it by redefining the quality of medical services: better care outcomes, higher

quality of life for the patients, higher medical employee efficiency,

streamlined workflows and protection from cybercrime.

Also, AI cuts down costs — Accenture predicts that it

will help the only US healthcare sector save $150 billion by 2026. In the face

of increasing demand for medical workers — the World Health Organization

estimates it to reach 80.2 million by 2030 — AI takes over a variety of tasks,

which reduces labor demand and workload.

c)

Treint

Investment Inc. & Med Tech

Treint

Investment Inc. is a company which intends to finance a pool of projects in

various countries with developed and emerging economies with the support of the

business community, allowing its members to participate directly and

transparently in the future flow of income and capital gains from these projects

by creating companies for development and profit locally. The primary

remuneration for Treint investment Inc. shareholders is income from the

Company's dividends, as well as the significant potential for capital

appreciation capital as a result of the resolution of business growth risks

resulting from promotion of projects, as well as the Company's own unique

IT-products powered by artificial intelligence in the medical sphere. In the

future, Treint investment Inc. plans to go Public and expand the geography of

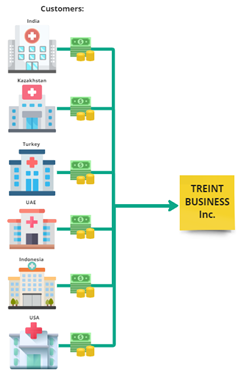

its Med Tech services in USA, India, Kazakhstan, Indonesia and the UAE. Treint

investment Inc. provides an innovative system of consultation through the use

of IT technology and professionals in the medical sphere, as well as the

opportunity to the company also participates in the equity of the real

business. Thus, Treint investment Inc. program addresses a significant lack of

accessibility to Medical services and equity participation by offering

potential holders a more clearly defined, more predictable future revenue

stream from existing business and global development projects, turned into an

international digital medical instrument.

This

is a unique opportunity to become a co-owner, shareholder of Treint Investment

Inc., which operates in the Medical sector.

IT-products is

powered by artificial intelligence, this will help:

i)

conduct transparent financial analytics;

ii)

predict the dynamics of the clinic

development receive smart;

iii)

recommendations for optimizing business

processes receive;

iv)

profit reporting and track the work of

employees.

d)

Description

of projects:

Treint Business -

a technology that can help hospitals solve their biggest problems and deliver

better patient outcomes. Platform is designed to be intuitive and easy to use,

so healthcare professionals can focus on what really matters - delivering

exceptional care to their patients. Treint Business can quickly and accurately

analyze large volumes of data, providing healthcare providers with the insights

they need to make informed decisions about patient care.

This can help to improve patient outcomes, reduce the

risk of errors, and streamline the care delivery process. Treint Business can

help healthcare providers address this issue by providing advanced billing and

revenue cycle management dashboards.

e)

Perspective

of Treint’s Solutions in the MedTech Industry:

Treint’s solutions emerge as a beacon of innovation in

the dynamic landscape of the medical technology (med tech) industry. With its

platform Treint Business, the company not only addresses critical challenges

within healthcare but also redefines the way medical professionals and

individuals engage with health and wellbeing. The perspectives of these

projects within the med tech industry are as follows:

● Advancing

Healthcare Management:

Treint Business holds immense promise in advancing

healthcare management practices. By seamlessly integrating intuitive design

with powerful data analysis, the platform empowers healthcare professionals to

navigate complex data landscapes effortlessly. The ability to quickly and

accurately analyze large volumes of patient data heralds a new era of informed

decision-making. This perspective not only streamlines the care delivery

process but also bolsters the confidence of healthcare providers in delivering

exceptional patient care.

● Transforming

Patient Outcomes:

Treint Business stands as a catalyst for

transformative patient outcomes. Through its insights-driven approach, it

offers a tangible pathway to improving patient care quality. The ability to

reduce the risk of errors and enhance the accuracy of diagnoses fosters an

environment of trust between medical professionals and their patients. This

perspective envisions a healthcare ecosystem where optimized decision-making

translates to elevated patient satisfaction, better treatment outcomes, and

ultimately, healthier lives.

● Financial

Efficiency and Transparency:

The integration of advanced billing and revenue cycle

management dashboards in Treint Business introduces a fresh perspective on

financial efficiency within healthcare institutions. By providing healthcare

providers with comprehensive tools for financial oversight, the platform

streamlines billing processes and minimizes revenue leakage. This perspective

aligns with the industry's growing emphasis on optimizing operational

efficiency while ensuring transparent and accurate financial management.

In conclusion, Treint’s solutions introduce a fresh

perspective to the med tech industry by addressing critical aspects of

healthcare management and patient engagement. With its commitment to

data-driven insights, personalized care, and transformative outcomes, Treint

stands poised to make a lasting impact on how healthcare is delivered and

experienced in the modern age.

f)

Development

plan 2023-2025

Treint Business:

● Treint

Business Platform – V1, V2 launch in India & Republic of Kazakhstan

● Penetrate

first 100 hospitals in India & Republic of Kazakhstan

● Treint

Business Platform – V1, V2 launch in Turkey & UAE

● Treint

Business Platform – V1, V2 launch in Indonesia & USA

● Integration

Treint Business with Digital Medical Insurance in USA

● Treint

Business: Online Medical Bank

● Treint

Business: Integration with Online Medical Bank

g)

Momentum:

a great opportunity to MED TECH

Artificial intelligence (AI) presents compelling

implications for healthcare, and the opportunities inherent in an

organization’s ability to use big data, complex decision trees, and machine

learning align well to assist with the current challenges within the industry.

The capabilities of AI and other technology-based tools to improve data

accuracy and process efficiency and support overall financial improvement for

the revenue cycle present compelling cases for organizational investment.

The estimated impact attributed to AI is more than

$150 billion in clinical and operational savings worldwide by the year 2022,

according to a recent Frost & Sullivan study. For revenue cycle leaders,

there are many opportunities to harness this technology to improve performance.

Just as clinical workflows should engage resources at the top of their license,

taking advantage of AI is a way to ensure you are getting the maximum benefit

from your staffing, technology, and organizational management investments. The

ability to take large portions of data and identify predictive algorithms,

determine repetitive tasks, validate financial results, or uncover

codependencies are all examples of where AI can be implemented to enhance your

revenue cycle’s performance.

The Role of AI in Revenue Cycle: Opportunities to

Consider

AI has implications across the revenue cycle, from

discrete processes to holistic data analyses across the continuum.

Opportunities will continue to expand as greater complexity is inherently

introduced through expanding clinical protocols and increasingly complex payer

contracts, as well as the availability and warehousing of comprehensive data

sets.

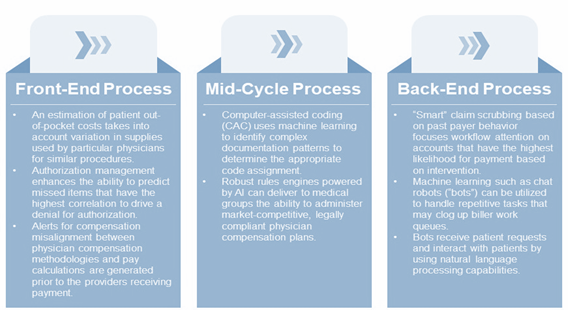

The following figure shows some of the existing

functionalities of AI within the healthcare revenue cycle:

In addition,

cross-functional processes are listed below.

i)

Exceptions-Based Reporting: Details

statistically significant departures from the norm so the organization can

focus on opportunities for improvement

ii)

Real-Time Quality Assurance: Strives

to ensure data is as clean as possible for use downstream in the revenue cycle

iii)

Physician Compensation: Effectively

tracks and measures physician compensation plans against organizational goals

iv)

Denial Management: Provides

the ability to uncover cross-functional or codependent trends and, in doing so,

helps lead to root cause identification and targeted action plans specific to

payer, provider, or other specific process gaps

v)

Data Normalization: Normalizes

content across hundreds of different commercial and government payers and

product types to create consistency

vi)

Data Mining: Analyzes

data to derive significant insights based on patient attributes to determine

appropriate actions (e.g., gender, medical history, income) or expectations

vii)

Process Automation: Utilizes

software designed to interact with the user interfaces to automate repetitive,

time-consuming manual tasks.

h)

Legal

Structure

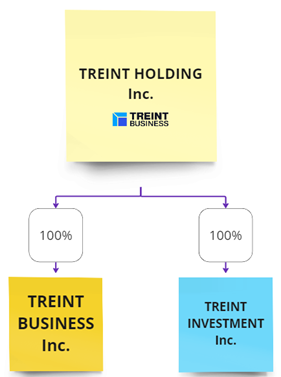

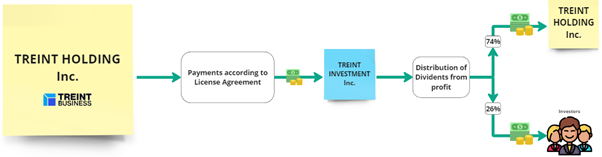

In short, legal structure looks like this:

A.

Holding Structure

Treint

Holding Inc.

Location:

Delaware, USA

Principal

Asset: Intellectual Property Rights pertaining to IT Product (Treint Business)

Role:

Treint Holding Inc. assumes the role of a holding entity with proprietary

interests in critical intellectual property assets.

Intellectual

Property: Treint Holding Inc. possesses exclusive entitlements to IT products

developed by the corporate consortium.

Owner:

Treint Business Inc.

B.

Operating Entities

Treint

Business Inc.

Location:

Delaware, USA

Function:

IT Product Development

Operations:

•

Conducting comprehensive research, formulation, and deployment of cutting-edge

IT products and solutions within the Medical Technology sector.

C.

Investment Instrument

Treint

Investment Inc.

Location:

Delaware, USA

Principal

Objective: Capital Mobilization and IT Product Commercialization

Operations:

•

Raising capital through targeted private placements, according to an exception

under rule 506 (c) Reg. D.

•

Subsequent commercialization of IT product - Treint Business in strict

alignment with the terms stipulated in the Licensing Agreement executed with

Treint Holding Inc.

The

execution overview elucidates the distinct functions each entity fulfills,

emphasizing the strategic alignment between their activities and the

overarching corporate goals.

3.

OUR SHARES

a)

Shares

Under

Regulation D Rule 506(c), the term "share" refers to a unit of

ownership in the capital (equity) of a company that issues securities

(typically common stock) through a private placement. In the context of Rule

506(c), a "share" represents a unit of ownership in the company's

capital that investors can acquire as a result of investing in the company.

Regulation Rule 506(c) establishes the rules and conditions under which such

securities can be privately offered and sold to accredited investors and non

accredited investors.

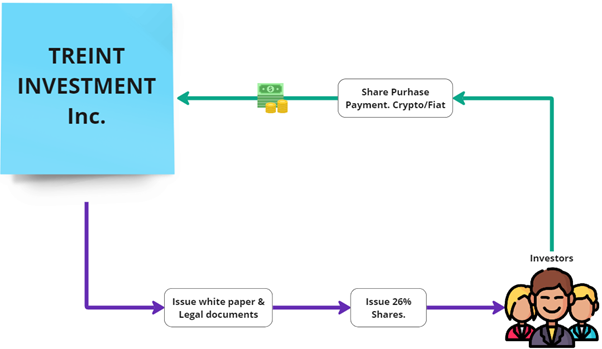

b) Share Offering (SO) Structure

In

short general structure of SO is as follows:

c)

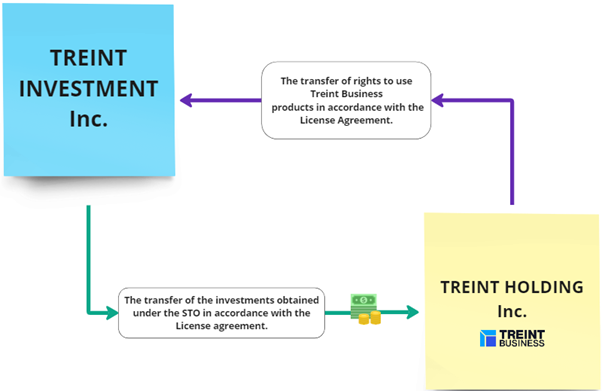

Purchase

structure, in practical terms, how does the SO and License Agreements work:

i)

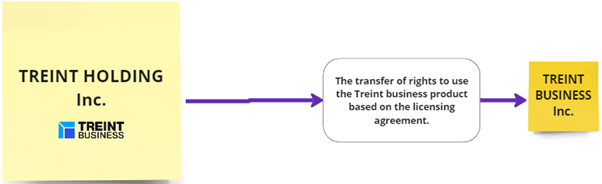

License agreement under which Treint

Investment Inc. (Licensee) - receives the rights to use Treint Business product

and transfers to Treint Holding Inc. (Licensor) the investment funds raised

under SO for development and promotion of Treint Business product.

ii)

The License agreement under which

companies Treint Inc. (Licensee), Treint Business Inc. obtain the rights to use

the Treint Business product, respectively, and make payments to Treint Holding

Inc. (Licensor) as stipulated in the License Agreement.

iii)

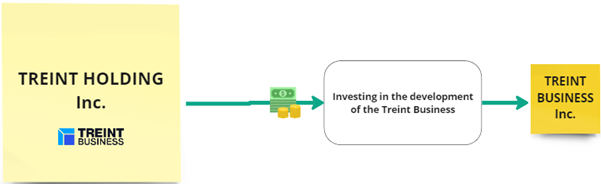

Treint Holding Inc. invests in its

subsidiary company Treint Business Inc. for the development of the Treint

Business product.

iv)

Treint Business Inc. promote and deliver

their services based on the rights obtained through the Licensing Agreement for

Treint Business product.

v)

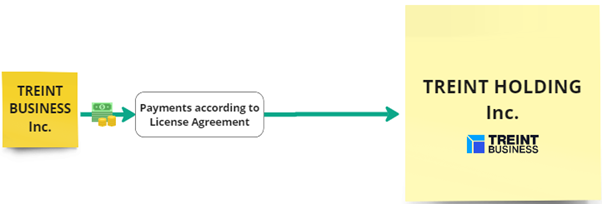

Treint Business Inc. make payments to the

Licensor (Treint Holding Inc.) based on the License Agreements:

vi)

The Licensor (Treint Holding Inc.) under

the License Agreement makes a payment to the Licensee (Treint Investment Inc.)

. Further, Treint Investment Inc. shall distribute dividends to all

shareholders of Treint Investment Inc.

vii)

After KYC/AML approvals, each Purchaser

(1)

subscribes shares by entering into terms

and conditions of purchase and delivering crypto or Fiat. On the specified

delivery date, the Issuer provides the Purchaser with Shares;

(2)

The Issuer exchanges the cryptocurrencies

received for fiat currency or Fiat and invests directly into Target Assets via

Companies registered in USA;

(3)

The funds are deployed for the acquisition

of Treint Business (Target Assets);

(4)

Treint Investment Inc. manages Target

Assets and receives a remuneration, as defined below;

(5) Issuers

may then reinvest proceeds of sale into further Target Assets or may exchange

proceeds for crypto or a Fiat and profits pro rata to the Shareholders in

crypto or a Fiat, as described in the item “Benefits for Shareholders” of the

White Paper.

d)

Client Perspective and User Experience

We

are designing a visually, intuitive and user-friendly interface for purchasers

to access our offer.

The interface allows you

to:

-

Select the required number of shares to

purchase

-

Familiarize yourself with the PPM

-

Familiarize yourself with the KYC/AML

policy

-

Enter necessary information about the

Buyer, upload necessary files and go through the KYC/AML procedure

-

Familiarize with Project Whitepaper

-

Automatically pull Buyer's data into Share

Purchase Agreement

-

Sign Share Purchase Agreement remotely

-

Make payment in fiat or cryptocurrency

-

Get access to personal cabinet with

received shares https://stocktreasury.com

e)

Benefits

for Shareholders

Our

shares intends to provide Shareholders with the following benefits, namely:

● Access to investments in Online Service to foreign

purchasers that may be unable to invest directly in Med Tech project because of

lack of international & local operational experts;

● An

evergreen vehicle that reinvests all or a large part of the cash flow from

operations into new opportunities;

● Future

liquidity in a Med Tech market;

Shareholders

have several potential ways to profit from the purchase of Shares:

o Upon

certain conditions outlined below, Shareholders will be eligible to receive

periodic dividends from existing Treint Products income produced by the

Target Assets; and

o Profit

distribution will be carried out through cryptocurrency or Fiat.

o A

unique opportunity to become a co-owner, shareholder international investment

portfolio, which operates in the Med Tech sector.

The

terms and mechanisms for distribution of profits.

As

a US foundation company, the Issuer will designate Shareholders as a class of

beneficiary of the Issuer. Under such designation, and subject to the terms

and conditions of the purchase, the Issuer will set out terms including, but

not limited to, the following:

o Each

Shareholder will be granted a proportionate right to any profit that is

declared and made by the Issuer, such right proportionate according to the

number of Shares held by such Shareholder, each of them will be determined

during the payment of dividends;

o The

directors of the Issuer will, at all times, have sole discretion as to whether

the profits generated by the Target Assets (including any capital gains) are

to be partially or fully distributed to Shareholders through the payment of

dividends, reinvested or used for other purposes (including, but not limited

to, satisfying liabilities, expenses, running costs and other fees);

4.

RoadMap

|

2023

|

Q1

|

- Treint Business Platform – V1 launch

in Kazakhstan

- Setup company in USA Treint Business

Inc.

|

|

Q2

|

- Setup company and Office in India

- Treint Business Platform – V1 launch

in India

|

|

Q3

|

- Treint Business Platform – V2 launch

in India & Kazakhstan

- Treint Business Platform – V1 launch

in Turkey

- SO Treint Investment Inc. launch

|

|

Q4

|

- Penetrate first 100 hospitals in India

& Kazakhstan

- Treint Business Platform – V2 launch

in Turkey

|

|

2024

|

Q1

|

- Opening in Dubai: Treint Business

Platform – V2 launch

|

|

Q2

|

- Integration Treint Business with

Digital Medical Insurance

- Opening Treint Business in US

|

|

Q3

|

- Treint Business: Opening in Indonesia

|

|

Q4

|

- Treint Business: Online Medical Bank

|

|

2025

|

|

- Treint Business: Integration with

Online Medical Bank

|

5.

Target

assets - Key aspects and indicators

Target

Asset management will be aligned with the proposed investment thesis described

throughout this document:

Preparation

of the Target Assets for sale in the Med Tech product context involves various

activities such as launching the company's platform, establishing an office,

hiring local experts, validating and training Artificial Intelligence, engaging

legal support, adapting the platform to different languages, fulfilling

regulatory obligations, and more. The estimated expenses for these tasks

typically range from 20% to 30% of the total cost of Med Tech products.

Profits

generated from the sale of the company's Med Tech product will be recorded by

Treint Business Inc. and distributed through dividends, which will support the

distribution of dividends to the Shareholders.

All

the business decisions associated with the investment in Target Assets will be

taken by Treint Investment Inc., (as determined by the Issuer) as applicable of

date and time to be determined by the Issuer in its sole discretion;

The

declaration of dividends by the Issuer will not give rise to a debt as between

the Issuer and the shareholder or any other person; or a trust relationship as

between the Issuer and the shareholder or any other person or the holding on

trust of any property on behalf of the shareholder or any other person by the

Issuer;

Any

payment following a declaration of dividends to shareholders will be made on a

date determined by the Issuer in its sole discretion;

Any

advance notice of dividends Date and the amount of either Cryptocurrency or

Fiat to be paid pursuant to each share will be given by the Issuer via a

website or through any other reasonable means as determined by the Issuer;

The

dividends will be made on the Date only to those shareholders that have

satisfied the Issuer´s anti-money laundering (“AML”) and “Know your Customer”

(“KYC”) requirements with respect to such shareholder (together, the

“Dividends Information”) as periodically determined by the Issuer;

Where

a Shareholder fails to supply sufficient Dividends Information to the Issuer by

the Date, such Shareholder will not qualify to not be a recipient of such

Dividends (in such case, a “Late Holder”) and the Issuer can delay any

Cryptocurrency or Fiat shall be paid in its sole discretion;

The

Late dividends that is retained by the Issuer shall not give rise to a debt as

between the Issuer and the shareholder or any other person; or a trust

relationship as between the Issuer and the shareholder or any other person or

the holding on trust of any property on behalf of the shareholder or any other

person by the Issuer; and should a purchaser transfer a share to any other

person, such initial purchaser will have no right to any Dividends in relation

to such Share following such transfer.

The

terms above are a general overview of the terms of designation of beneficiary

to be determined by the directors of the Issuer at its sole discretion, and

may not be relied upon by potential purchasers or Shareholders for any reason

or for any claim including, for example, misrepresentation or as contractual

terms enforceable against the Issuer. The Issuer reserves the right to amend

the terms above for any reason it sees fit including, but not limited to, (a)

any further technical considerations as may be required or (b) in order for

the Issuer to comply with any of its legal or regulatory obligations.

In

the event of a conflict between this Whitepaper and the terms and conditions

of purchase, the terms and conditions shall prevail.

6.

TEAM

AND PACTUAL EXPERIENCE

a)

Company

At the moment the

holding company has already launched the beta product “Treint Business"

in India. Having expanded its geography, the company plans to launch its IPO by

2024. The above mentioned reasons are the main factors that make the project attractive

to investors. Attractiveness of the project:

i)

SO security;

ii)

The ready product Treint Business;

iii)

CROWE investment assessment;

Treint

Investment Inc. intends to fund a pool of projects in various countries with

the support of the business community, allowing its members to participate

directly and transparently in the future revenue stream and capital gains from

these projects.

By

2024 the company plans to go public and expand the geography of its legal

services in the CIS, Indonesia, UAE, India, Turkey and the USA. Treint Business

provide an innovative system through the use of IT technology and medical

professionals, as well as the opportunity to the company also participates in

the equity of the real business. Thus, Treint Business platform addresses a

significant lack of accessibility of MedTech services and equity participation

in firms by offering potential holders a more clearly defined, more predictable

future revenue stream from existing business and global development projects,

turned into an international digital legal instrument.

b)

Team

Sheikhislam

Sakhi

Founder,

CEO

Young

neurosurgeon & neuroscientist Medical background: category C in endoscopic

neurosurgery (Germany, Hamburg-Saar University medical center). Business

background: Entrepreneur from 16 yo, exited 3 businesses, founder of medical

educational platform and P2P delivery app. Currently founder and CEO of Treint

holding.

Aziz

Akkayev

CO-Founder

// CHIEF MEDICAL EXPERT

Aziz

Akkayev is an accomplished neurosurgeon, surgeon, and plastic surgeon who

completed his education at MUA University and St. Thomas hospital. With a

passion for medicine and a drive for excellence, he has trained and worked in

over 48 countries, honing his skills and gaining valuable experience in a

diverse range of healthcare settings. Throughout his career, Aziz has

consistently demonstrated a commitment to his patients' wellbeing and a

dedication to staying at the forefront of medical innovation. He is known for

his meticulous attention to detail, his compassionate bedside manner, and his

ability to perform complex surgical procedures with precision and skill.In

addition to his clinical work, Aziz is also a respected educator and mentor,

sharing his knowledge and expertise with the next generation of medical

professionals. He has authored numerous research papers and has been invited to

speak at medical conferences around the world.

Rachit

Tomar

Co-founder

// Chief Technical Officer

Rachit

Tomar is a highly accomplished technology executive with a decade of experience

in the IT industry. As the current Chief Technology Officer (CTO) at a leading

healthcare SaaS product company, Rachit leads a team of skilled engineers in

the design and development of innovative software solutions that cater to the

complex needs of the healthcare sector. Throughout his career, Rachit has

demonstrated a deep understanding of software engineering and a passion for driving

technological advancement. He has successfully led multiple healthcare SaaS

projects, leveraging his expertise to deliver outcomes that benefit patients,

providers, and payers alike. Prior to joining the healthcare industry, Rachit

worked in several other verticals, including finance, retail, and logistics. He

holds a Bachelor's degree in Computer Science and has completed numerous

certifications in software engineering and management. Rachit is an active

member of the tech community, frequently speaking at conferences and mentoring

emerging talent in the field.

Khalel

Tuganbayev

Chief

Legal Officer

Khalel

is a qualified lawyer with extensive experience in corporate and commercial

law, civil law, employment law, finance law, litigation and arbitration.Before

joining Treint, Khalel spent more than 10 years in legal consulting. He was the

Manager of legal services in one of the Big4 companies, and the Director of a

major law firm. Khalel worked with international, foreign and local clients,

providing advice on a wide range of legal issues and representing in Kazakhstan

courts and international arbitrations.Khalel was an expert of the World Bank

and assisted the Ministry of Justice and the Supreme Court in development of a

wide range of Kazakhstan legal acts.

Alzhan

Sainov

Co-founder

// Chief Crypto Expert

Alzhan

Sainov is a Product Manager and Co-Founder of Well It, a successful technology

startup that is revolutionizing the industry. He graduated from Shanghai

International Studies University and Zhejiang Gongshang University, and has

since become an expert in the field of cryptocurrencies.Since 2018, Alzhan has

been actively researching and studying the topic of cryptocurrencies, and has

become a well-respected figure in the industry.In 2020, Alzhan participated in

the Binance trading tournament and ranked among the top 20 teams for trading on

the Binance exchange. He is a creative and driven individual who is always

seeking new challenges and opportunities to grow the company and improve its

products.

Puru

Rathi

Full

Stack Developer

Puru

is a full-stack developer with 5 years of experience in PHP, Laravel, and

ReactJS. He has a strong understanding of web development principles and

experience working on both front-end and back-end projects. He is proficient in

PHP and Laravel for building robust and scalable back-end systems, as well as

ReactJS for creating interactive user interfaces. His expertise also includes

database design, API development, and software testing. He is a quick learner

and a team player, always striving to improve my skills and contribute to the

success of the projects he works on.

7.

Focus

on value creation - the Treint differentials

In

the dynamic landscape of Med Tech, the paramount objective is to create lasting

value for both patients and stakeholders. We believe that innovation and

dedication to value-driven solutions, empowered by Artificial Intelligence

(AI), are the pillars of our mission. Our commitment extends beyond the

development of cutting-edge products; it encompasses the entire ecosystem of

care, from diagnostics to treatment and beyond.

Our

approach centers on patient-centricity, where every technological advancement,

driven by AI, is measured by its potential to improve patient outcomes, enhance

the quality of care, and reduce healthcare costs. We recognize that value is

not confined to the realm of technology alone but extends to the entire

healthcare experience.

In

our pursuit of value creation, we focus on several key principles:

AI-Powered

Insights: We harness the capabilities of AI to provide healthcare professionals

with actionable insights, enabling more accurate diagnoses, personalized

treatment plans, and predictive interventions.

Patient

Empowerment: AI is leveraged to empower patients with access to information,

control over their health data, and user-friendly tools that facilitate active

participation in their care.

Clinical

Excellence: Our AI-driven solutions support healthcare professionals by

providing precise diagnostic tools, streamlining workflows, and facilitating

data-driven decision-making, thereby raising the bar for clinical excellence.

Cost

Efficiency: We understand the economic pressures within healthcare. Our AI

technologies aim to optimize resource utilization, reduce unnecessary

expenditures, and enhance overall cost-effectiveness.

Regulatory

Compliance: We adhere rigorously to all regulatory requirements, ensuring that

our AI-based products meet the highest standards of safety, efficacy, and

compliance.

Continuous

Innovation: Our commitment to value creation is an ongoing journey, and AI

plays a pivotal role. We embrace innovation, research, and development to stay

at the forefront of AI-powered Med Tech advancements.

As

we embark on this journey, we invite investors, partners, and stakeholders to

join us in shaping the future of healthcare through the transformative power of

AI. Together, we can drive meaningful change, improve patient lives, and create

lasting value within the Med Tech sector.

8.

Technology

for Management

a)

Intelligence

i)

The use of artificial intelligence

technology and others.

ii)

Medical services are as accessible as

possible - at any time of the day or night - and require nothing more than a

smartphone and the Internet

b)

CRM:

Intelligent pricing, management and sales

i)

Partners classified by knowledge level,

pricing, marketing and commercialization

ii)

Sales process control

iii)

Efficient management with scale by mapping

potential buyers based on specific characteristics

iv)

Defining a sales strategy before a

customer purchases a service

c)

Sensing

for monitoring and analysis

i)

Liabilities, regulatory restrictions and

utility

ii)

Quick identification of any issues

d)

Business

Intelligence

i)

Task/workflow management, scripts to

analyze each case

ii)

Intelligent data to resolve all issues in

the medical field: performance metrics, time, pricing, etc. Integrated and

Applied Innovation

e)

Geospatial

Vision of 100% of Portfolio

i)

Process automation, service, and lead

generation.

ii)

Medical professionals have created

services for people and companies.

iii)

Online services allow you to receive

services without the actual participation

9.

Risk

factors

a)

Risk factors connected to governments

regulations

Governments

have significant influence over the economy of their own state. This influence,

as well as political and economic conditions, could adversely affect the

shares.

Governments

frequently intervene in the economy and occasionally make significant changes

in policy and regulation. The governments, recently elected, could have an

impact on inflation rates, interest rates, changes in tax policies, wage and

price controls, currency devaluations, capital controls, exchange controls and

several other matters. We cannot control or predict the government's future

policy decisions. Any uncertainty over whether the government will implement

changes affecting these and other factors may create instability and, as a

result, this may adversely affect the shares and their price. Regardless of the

fact that the field of MedTech services is protected by consumer demand,

politics has an impact on the field of business and investment.

b) Risks

in legal sphere

We

are subject to anti-corruption, anti- bribery, anti-money laundering, sanctions

and antitrust laws and regulations.

We

are required to comply with the applicable laws and regulations, and we may

become subject to such laws and regulations in other jurisdictions. We cannot

guarantee that our internal policies and procedures will be sufficient to

prevent or detect any inappropriate practices, fraud or violations of law by

our affiliates, employees, officers, executives, partners, agents, suppliers

and service providers, nor that any such persons will not take actions in

violation of our policies and procedures. Any violations by us or any of our

affiliates, employees, directors, officers, partners, agents, suppliers and

service providers of anti-bribery and anti-corruption laws or sanctions

regulations could have a material adverse effect on our business, reputation,

results of operations and financial condition.

c) Risks

relating to the share regulatory environment

Shares

are being closely scrutinized by various regulatory bodies around the world.

There is a substantial risk that in numerous jurisdictions, shares may be

deemed to be a security. For example, applicable securities laws may limit the

ability to hold more than certain amounts of shares, restrict the ability to

transfer shares, require disclosure or other conditions on purchasers in

connection with any sale of shares, and may restrict the businesses that

facilitate exchanges or carry out transfers of shares. Every Purchaser of a

share is required to make a diligent inquiry to determine if the acquisition,

possession and possible transfer of the shares are legal in its jurisdiction

and to comply with all applicable laws.

The

legal ability of the Issuer to provide shares in some jurisdictions may be

eliminated by future regulation or legal actions. In response to such action,

the Issuer may take actions that adversely impact you and the shares you hold,

including (a) ceasing operations or restricting access in certain

jurisdictions, (b) adjusting shares in such a way to comply with applicable

rules and regulations, (c) restricting distributions or payouts, or (d) ceasing

operations entirely.

In

regard to the Issuer, a filing has not been made with SEC, the main regulator

in the United States of America. The offering of shares is not registered or

regulated in the USA and the Issuer’s activities are not approved or guaranteed

by SEC or by the United States of America’s Government. Neither SEC nor any

other governmental authority in the United States of America has any obligation

to any Purchaser of shares as to the performance or credit worthiness of the

Issuer. Neither SEC nor any other governmental authority in the United States

of America has passed judgment upon or approved the terms or merits of the

offering of shares. SEC shall not be liable for any losses or default of the

Issuer or for the correctness of any opinions or statements expressed in this

White Paper. There is no investment compensation scheme available in the United

States of America to either (i) purchasers of shares or (ii) the Issuer.

d) Risk

factors relating to the share

Purchaser

may never receive a distribution:

Investors

may never receive any benefit from holding Treint Investment inc. shares. A

legally compliant trading market for shares may never be developed and

peer-to-peer transfers of shares received by Investors will not be permitted

unless and until shareholders are otherwise notified by the Company, which may

require holders to hold their shares indefinitely.

As

per the content of this White Paper, it is intended that shareholders will be

eligible to receive payments from the Issuer upon determination of a

distribution to shareholders by the directors of the Issuer. However, as per

these risk factors, the Issuer may never make a profit or have any funds

available to make a distribution to shareholders. Furthermore, it is possible

that shareholders will be ineligible to receive any payout due to the

determinations of the Issuer including, for example, where shareholders have

not provided KYC for AML purposes or where shareholders are citizens or

residents in those restricted jurisdictions as determined by the Issuer.

Furthermore,

any payout shall be subject to the designation terms of the shareholders as a

class of beneficiary of the Issuer. Such terms may restrict payments by the

Issuer under certain circumstances or restrict certain shareholders to any

payout where such payment would not be in the best interests of the Issuer or

would be in breach of any laws or regulations. Furthermore, the directors have

the power to determine that profits of the Issuer may be used for reinvestment

or any other purpose (such as satisfying any liabilities) and therefore may

choose not to make any distribution to shareholders during the time that the

holder holds the shares. Additionally, the shareholders may trade or transfer

the shares and therefore may lose all rights to any distribution following such

trade.

e) If

there is insufficient demand, the SO will be canceled:

If

there is insufficient demand, the SO will be canceled and purchase orders made

by purchasers may be canceled. In such a scenario, any amounts already paid by

purchasers will be refunded net of charges incurred, if any.

f) Shares

are non-refundable:

Save

where the SO is canceled, the Issuer is not obliged to provide shareholders

with a refund for any reason and shareholders will not receive money or other

compensation in lieu of a refund.

Statements

set out in this White Paper are merely expressions of the Issuer’s objectives

and desired work plan to achieve those objectives and no promises of future

performance or price are or will be made in respect to shares, including no

promise of inherent value and no guarantee that shares will hold any particular

value.

g) Shares

are provided on an “as is” basis:

shares

will be provided on an “as is” basis. The Issuer and each of their respective

directors, officers, employees, equity holders, supervisors, affiliates and

licensors make no representations or warranties of any kind, whether express,

implied, statutory or otherwise regarding shares, including any warranty of

title, merchantability or fitness for a particular purpose or any warranty that

shares will be uninterrupted, error-free or free of harmful components, secure

or not otherwise lost or damaged. Except to the extent prohibited by applicable

law, the Issuer and each of their respective directors, officers, employees,

equity holders, supervisors, affiliates and licensors disclaim all warranties,

including any implied warranties of merchantability, satisfactory quality,

fitness for a particular purpose, non-infringement, or quiet enjoyment, and any

warranties arising out of any course of dealings, usage or trade.

h) The

shares will be entirely uninsured:

The

shares are not like bank accounts or other similar accounts. The shares are

entirely uninsured and any value they may hold at any time may decrease or be

eliminated in the future.

i) The

purchase of the shares involves liquidity risks that may subject a shareholders

to losses

There

is no existing trading market for our shares, and we have no guarantees that

the shares will be negotiated in any exchange or secondary market. The shares

are a new issuance of digital assets for which there is no established public

market. Moreover, there can be no assurance that any such existing share

exchanges will accept the listing of shares or maintain the listing if it is

accepted. There can be no assurance that a secondary market will develop or if

a secondary market does develop, that it will provide shareholders with

liquidity of investment or that it will continue for the life of the shares.

Additionally, the Issuer cannot guarantee that there will be enough liquidity

to sell shares on any exchange or secondary market.

In

addition, at times it may be difficult to dispose of the service assets due to

low or nonexistent demand or negotiability. In such cases, we may face

difficulties in negotiating or disposing of such assets at a convenient price

or time. As a consequence, we depend on the income from our investments to make

distributions to shareholders.

j) We

will have the right to cancel the shares:

We

shall have the right to cancel the shares of a shareholder at any time at our

sole discretion, including if the relevant shareholders have not provided

information requested by us (including, but not limited to, information

requested in connection with AML/KYC purposes). Any such cancellation shall be

made in exchange for a cancellation price, which will be based on the current

fair market value attributed to the share. On the other hand, shareholders

will have no right to force or induce a repurchase or redemption of the shares.

k) Risks

relating to blockchain networks

Potential

purchasers may not have the appropriate skills to secure, trade or collect

distributions using the shares or to comply with the requirements of the Issuer

(including, but not limited to, information requested in connection with a

periodic shareholders check). Knowledge of blockchain asset exchanges and other

industry participants may be needed to comply with the requirements of the

offering.

In

addition, the blockchain, which will be used for shares, is susceptible to

mining attacks, including double-spend attacks, majority mining power attacks,

“selfish-mining” attacks, and race condition attacks, as well as other new

forms of attack that may be created. Any successful attacks present a risk to

shares, expected proper execution and sequencing of shares, and to expected

proper execution and sequencing of contract computations in general. Mining

attacks may also target other blockchain networks with which shares interact,

which may consequently significantly impact shares.

l) Loss

of private keys may render shares worthless:

If

a private key (seed phrase) is lost, destroyed or otherwise compromised and no

backup of the private key is accessible, you will not be able to access the

blockchain asset associated with the corresponding address, and the Issuer will

not be able to restore the private key. Any loss of private keys relating to

digital wallets used to store blockchain assets may result in a complete and

irreversible loss of the shares.

m) Exchange

risks:

If

Purchaser sends Stable Coin to the Issuer from an exchange or an account that

Purchaser does not control, shares will be allocated to the account that has

sent Stable Coin; therefore, Purchaser may never receive or be able to recover

Purchaser’s shares. Furthermore, if Purchaser chooses to maintain or hold

shares through a cryptocurrency exchange or other third party, Purchaser’s

shares may be stolen, lost or retained by the exchange. The Issuer cannot

control the exchange process on secondary markets or exchanges and therefore

cannot guarantee the safety of shares.

n) Risk

of incompatible wallet services:

The

wallet or wallet service provider used for the acquisition and storage of

shares has to be technically compatible with shares. Failure to ensure this may

result in the Purchaser not being able to gain access to its shares.

o) Risk

of weaknesses or exploitable breakthroughs in the field of cryptography:

Advances

in cryptography, or other technical advances such as the development of quantum

computers, could present risks to cryptocurrencies, shares, which could result

in the theft or loss of shares.

Quantum

computers pose several risks to cryptocurrencies due to their incrementally

faster processing speeds. Although application- specific integrated circuits

(ASICs) used to mine cryptocurrencies are likely to remain faster than quantum

computers in the near term, within the next 10 years, experts expect quantum

computers to outpace them, with potentially harmful effects on the ledgers. For

example, if a group of cryptocurrency miners controlled a majority of the

computational power on the network, it could control the ledger in a manner

adverse to other users. Another issue could arise with private keys, as quantum

computers may be able to hack them using the public key. Certain protocols

could be changed to be resistant to hacking by quantum computers, but such

alternatives may not exist until well into the future if at all. If quantum

computers are used to hack cryptocurrencies without our knowledge, ledgers will

be affected, which could have a material adverse effect on our business. The

Issuer cannot guarantee the resistance of shares and the protocol to hacking,

malware or any other types of attacks.

p) Irreversible

nature of blockchain transactions:

Transactions

involving shares that have been verified, and thus recorded as a block on the

blockchain, generally cannot be undone. Even if the transaction turns out to

have been in error, or due to theft of a user’s shares, the transaction is not

reversible. Further, at this time, there is no governmental, regulatory,

investigative, or prosecutorial authority or mechanism through which actions or

complaints can be made regarding missing or stolen shares. Consequently, the

Issuer may be unable to replace missing shares or seek reimbursement for any

erroneous transfer or theft of shares.

The Treint program may be the target of

malicious cyberattacks or may contain exploitable flaws in its underlying code,

which may result in disruption of business, security breaches and the loss or

theft of shares. If the security of Treint is compromised or if the Treint

platform is subjected to attacks that frustrate or thwart our users’ ability to

access the Platform, their shares or the Treint Platform products and services,

users may cut back on or stop using the Treint Platform altogether, which could

seriously curtail the utilization of the shares and cause a decline in the

market price of the shares.

There

can be no assurances that the Treint platform and the creating, transfer or

storage of the Treint Investment Inc. shares will be uninterrupted or fully

secure which may result in a complete loss of Investors’ Treint Investment Inc.

shares

q) The

Issuer is subject to cybersecurity and data loss risks or other security

breaches:

The

shares involve the storage and transmission of shareholders’ proprietary

information, and security breaches could cause a risk of loss or misuse of this

information, and of resulting claims, fines and litigation. The shares may be

subject to a variety of cyber-attacks, which may continue to occur from time to

time. An attack or a breach of security could result in a loss of private data,

unauthorized trades, an interruption of potential trading for an extended

period of time, violation of applicable privacy and other laws, significant

legal and financial exposure, damage to reputation, and a loss of confidence in

security measures, any of which could have a material adverse effect on the

financial results and business of the Issuer. Attackers can also manipulate

the crypto assets markets. Moreover, markets for cryptocurrencies are not

typically subject to oversight by any prudential or by other regulators that

impose minimum financial or business conduct standards, or that require minimum

cybersecurity protections. Additionally, attackers can target platforms that

buy and sell crypto assets and digital wallets that hold cryptocurrencies.

A

decrease in the price of a single blockchain asset may cause volatility in the

entire blockchain asset industry and may affect other blockchain assets